Many of our local nonprofits have put considerable effort into diversifying their boards of directors. That’s good work toward the “D” in DEI—diversity, equity, and inclusion. Today, let’s give some attention to the concept of equity.

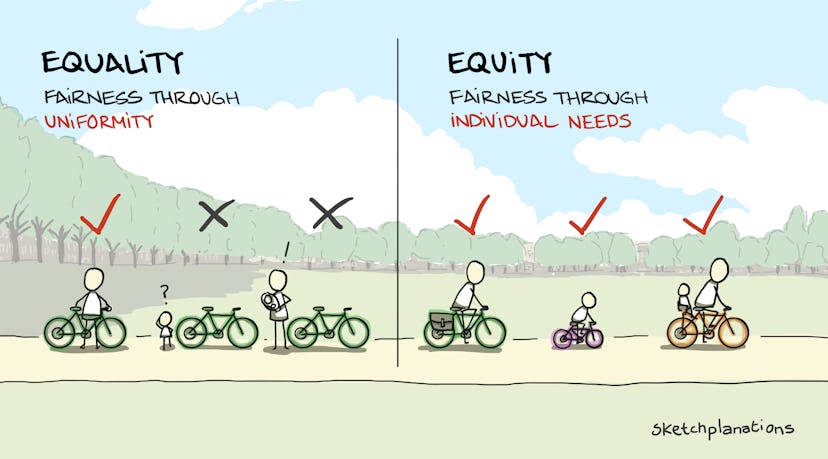

First, let’s differentiate equity from equality. Equity refers to fair treatment, access, opportunity, and advancement for all individuals. Unlike equality, which implies treating everyone the same, equity recognizes that different people have different circumstances and allocates resources and opportunities accordingly. College scholarships based on need are one classic example of equity. The Americans with Disabilities Act is another.

There are numerous visual depictions to contrast the two concepts. I like this one, from Sketchplantations, used by permission.

Removing Barriers

One powerful way for nonprofit leaders to promote equity is to identify and remove barriers. Attorney Heidi Christianson suggests two places to start. One is barrier language. She recommends eliminating “language that feels like ‘legalese’ and processes that are unnecessary. For example, “If Bylaws and policies are to represent an organization’s collective expectations, they need to be welcoming to all people.” In fact, composing such documents in clear, straightforward language may make it easier for everyone to understand and comply with them!

The second is barriers to service. For instance, Christianson encourages us to “think about meeting times, prohibition on board compensation, and length of board terms.” Look at your list of board expectations or your board member job description. Though not intending to, do they automatically put hurdles in the path of board service for some people but not others?

Here are additional resources for advancing equity in the nonprofit board room:

Find Us On Social Media: